Home About Request Kyle Shop Services

In The

BL

AQ

Live Life

Home About Request Kyle Shop Services

Request Kyle to Speak

Ways to Work With Kyle

Complete the form below if you would like more information

about hosting Kyle at your eventt

1. Credit Education

Email: kmathews@kmathewsgroup.com

Call: (713) 997-9464

Name

2. Reentry

3. Seminars

4. Workshops

Email

5. Conferences

6. Summits

Best Contct Number

Organization or Event Name

Don’t see your event on this list? Complete the form to see if we can accommodate your request.

Event Type

^

When and Where is Your Event?

Estimated Speaking Budget

^

Tell Us About Your Goals

Submit

© Powered by: In The Blaq

Home About Request Kyle Shop Services

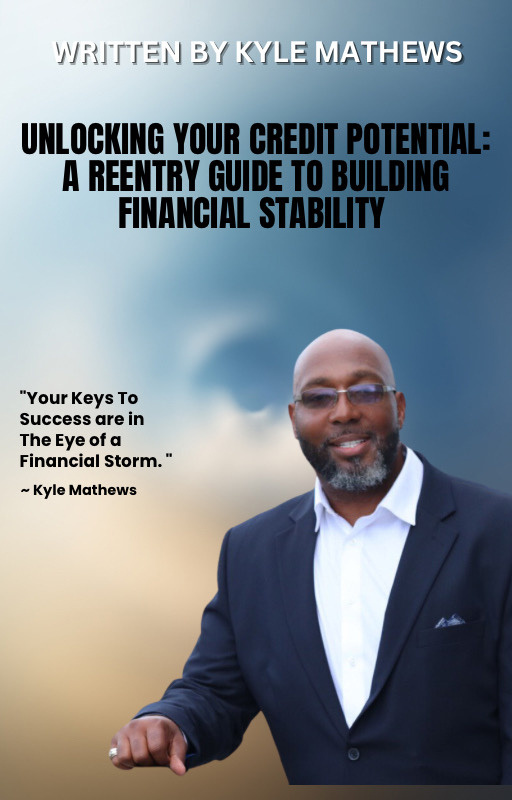

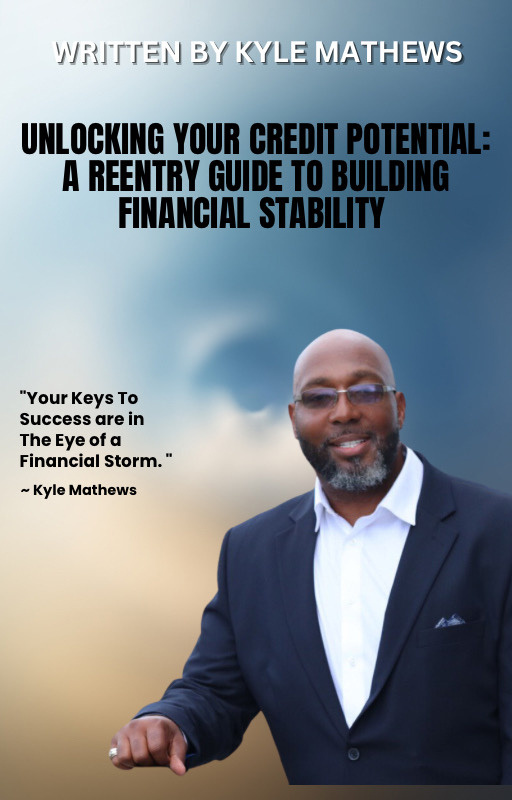

- I assist citizens, both current and formerly incarcerated, build and leverage credit for their financial freedom

Explore how I inspire and people to embrace the power of credit

Free Preview

© Powered by: In The Blaq

Home About Request Kyle Shop Services

REENTRY AND CREDIT

Do the below stats trouble you?

About 68% of all returning citizens released from prison are rearrested within the first three years of their release

Less than 1% of all returning citizens return to society with an excellant credit score (+750)

Returning citizens have the most trouble securing suitable housing upon their release. Low credit scores equal higher rents and mortgages

Financially and socially, there are only two ways to live life; In The Red or In The Blaq. I want you to always live In The Blaq!

If the above statements trouble you, let me help!

© Powered by: In The Blaq

Get Started

Home About Request Kyle Shop Services

There is more credit card delinquency now than during the financial crisis of 2008

With a 680 credit score, a person will pay around $40 a month extra on a $400K home. That equates to an extra $14K

The average credit scores by community:

White: 721

Hispanic: 667

Black: 621

© Powered by: In The Blaq

Get Started

Home About Request Kyle Shop Services

WHO IS KYLE?

Hello, I’m Kyle Mathews. My life is a testament to resilience, transformation, and the power of financial literacy. My path has been marked by significant adversity, from surviving a gunshot wound during a robbery, to enduring a 40-year prison sentence and the heart wrenching loss of my mother to MRSA while I was incarcerated.

These experiences shaped me, but they did not define my destiny.

In the depths of my challenges, I discovered the transformative power of financial literacy. It became my beacon of and empowerment, teaching me the value of budgeting, saving, investing and planning for a brighter future. Financial education was not merely about managing money; it was about gaining the freedom to make informed decisions, to take control of my life, and to build a solid foundation for reentry into society.

Today, I stand as a living testament to the fact that it’s possible to turn one’s life around through education and empowerment. My mission is to share the incredible impact of financial literacy, to inspire others to seize control of their financial futures, and to honor my mother’s memory by living a life of purpose, resilience, and empowerment.

Welcome to my journey from adversity to empowerment. Let’s explore the transformative power of financial literacy together.

© Powered by: In The Blaq

Home About Request Kyle Shop Services

There is more credit card delinquency now than during the financial crisis of 2008

With a 680 credit score, a person will pay around $40 a month extra on a $400K home. That equates to an extra $14K

The average credit scores by community:

White: 721

Hispanic: 667

Black: 621

© Powered by: In The Blaq

Get Started